The crux of the prospect theory is this: We have an irrational tendency to be less wil

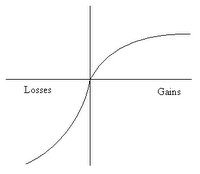

ling to gamble with profits than with losses. This means selling quickly when we earn profits but not selling if we are running losses. [Tvede 1999]. This can be represented by a value function as shown on the right. As shown, losses hurt more than gains satisfy.

ling to gamble with profits than with losses. This means selling quickly when we earn profits but not selling if we are running losses. [Tvede 1999]. This can be represented by a value function as shown on the right. As shown, losses hurt more than gains satisfy.The key difference between the two theories is that the expected utility hypothesis describes how people should behave (prescriptive) when faced with choices, while the prospect theory aims to describe how people actually behave (descriptive).

Simple enough isn't it? But consider the implications:

- People hold on to stocks that have taken a beating hoping that they would go up some day

- People tend to sell off stocks sooner when they are going up - (leading to frequent stock market "corrections" as TV channels put it)

- People place a higher value on something they own, when compared to the same thing if they didn't own it. (People prefer certain gains)

- Your boss is more likely to approve your application for leave if it is in the form of a series of applications for 2 days each every 20 days over a 60 day period as opposed to a stretch of 6 days at a time.

- A person who owns an apartment will estimate its market rate (for rent) to be higher than what he would pay were he to take it on rent himself.

More about prospect theory.